America is focused on the criminal indictments against Donald Trump, but there is little discussion about one civil action that threatens significant financial harm upon the former President, namely THE PEOPLE OF THE STATE OF NY, by LETITIA JAMES -against- DONALD J. TRUMP et al, herein the (“Complaint”). This civil action includes his three children as defendants: Donald, Jr., Eric, and Ivanka. Given that some reports claim Trump’s net worth to be as low as $1.5Bn, a $250M pay-out from this one lawsuit alone, could represent a significant toll on Mr. Trump’s wallet, that is 17% of his entire net worth.

The relief sought by James is particularly troubling as it seeks to prevent Donald Trump, children, and all entities affiliated with Trump from managing businesses in New York. It also asks for the Court to appoint monitors and auditors to Trump businesses for the next five years, and it demands that Trump pay a disgorgement of $250M. The complaint asks for disgorgement, as it alleges that Trump benefited from interest savings based on fraudulent misrepresentations and also obtained insurance policies he should have never had access to. The allegations state that Trump fraudulently inflated the value of at least nine different assets, including one partnership. These inflated valuations, as per James, caused banks to offer Trump loans at extremely low rates and also he received insurance coverage he would have never been entitled to if, in fact, the true value of those properties had been properly reported. Due to the benefit of about $250M in Trump’s favor, for his alleged fraudulent scheme, James is asking the Court to force Trump to pay back that same amount to those entities he allegedly hoodwinked.

To be clear, this post has no political affiliation whatsoever; we have no intention to exonerate Trump or to prove Trump guilty of anything. We also will not address the laws that the Complaint states were violated or what the consequences of violating those laws should be. There is no legal analysis to be discussed here. Instead, this composition will address, in separate posts, the alleged financial improprieties that were committed by Trump for each of nine different properties cited in the Complaint. Our focus will be to demonstrate how njexpertwitness.com, or any other financial expert should go about working with Trump’s attorneys to analyze, assess risk, and propose a strategic plan to deal with the alleged financial fraud that he is being charged with.

TRUMP PARK AVENUE

TRUMP PARK AVENUE

502 Park Avenue New York, New York 10022

Facts about Trump Park Avenue:

32 floors

114 condominium apartments

8 penthouse suites

122 residential units

2 commercial spaces on the ground level

In ¶82-¶112 of the official Complaint, James alleges that Trump reported in a Statement of Financial Condition for the years 2011-2021 values for the Trump Avenue Property ranging between $90.9M and $350M. In 2011, Donald Trump, Jr. valued the real estate at $308M, $15M for the commercial spaces, and $293M for the unsold residential condominium units. An appraisal done in the later part of 2010, by the Oxford Group valued the same property at $72.5M, with $55.1M attributed to the residential units. That is a $235M discrepancy in value. Twelve residential units that were rent stabilized, furthermore, were valued by the Oxford Group at $750K because those tenants could not be forced to move out. The issue here, James goes on to explain, is that Trump used the offering plan prices to value unsold residential condominium units, not estimates of current market value and that Trump also ignored the fact that the rent stabilized units could not be sold. In 2011 those same twelve units were valued by Trump at $49.6M when they should have been valued at $750K, according to Oxford.

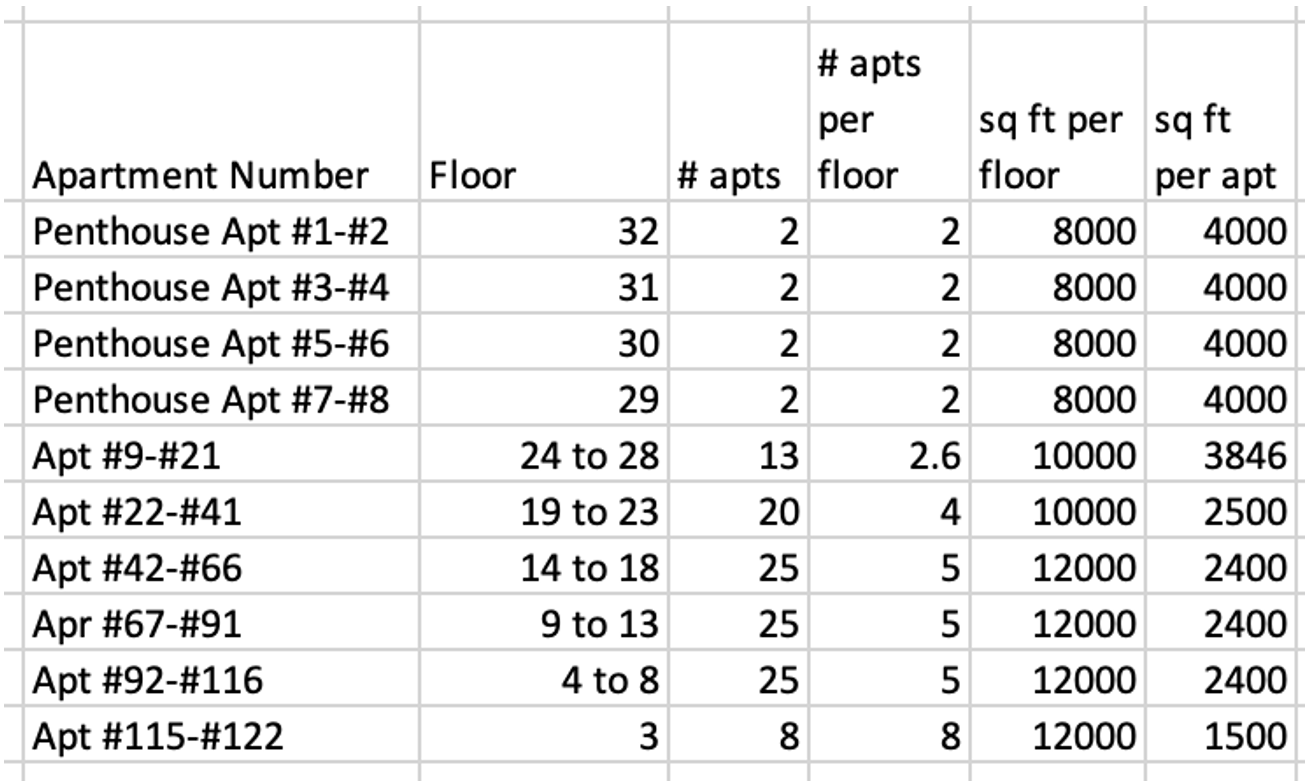

Now comes an explanation of the financial expert work that is required in this type of case. Trump Park Avenue boasts 122 residential units and two commercial spaces. The first step is to determine the correct value of the 122 units. There are a few approaches, but in this case the most accurate would be to use comparable sales. First we need Trump to provide a spreadsheet of all 122 units in the building, by floor, and the square footage for each unit. Consider Table 1, here below, as a working model for the square footage per floor and the square footage per apartment.

Table 1. Model data for 122 units in the Trump Park Avenue building based on what is publicly known. The total number at 122 and the floors are factual, but apartments per floor and square footage values are simulated in order to illustrate the calculations that are required for a formal valuation of the residential units.

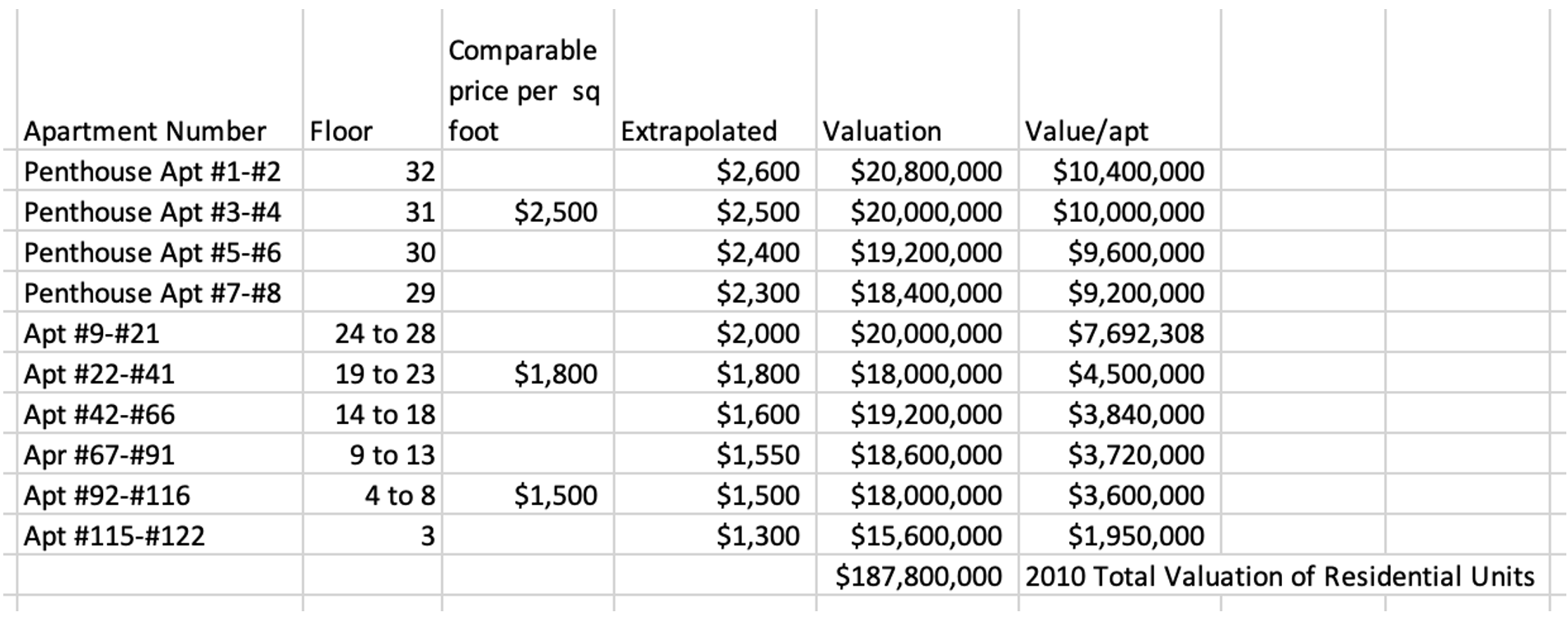

The next step is to find comparable residential units, sold during the same relevant time period, and to determine the price per square foot. By deriving the price per square foot, then we back into a price per apartment and a total price for the residential space. Adjustments need to be made by floor because a penthouse in the building, for example, would be priced substantially higher than a ground floor apartment. Table 2, here below, identifies three comparable sales by floor that can be used to extrapolate a price per square foot for all the other apartments.

Table 2. Model data demonstrating, in the third column, three comparable sales one for a penthouse apartment on the 31st floor ($2500 per square foot), the other for an apartment between the 19th and the 23rd floor ($1800 per square foot), and the third is for an apartment between the 4th and the 8th floor ($1500 per square foot). These comparable sales were used to calculate an extrapolated price per square foot for all other apartments and subsequently a proper valuation of all residential units.

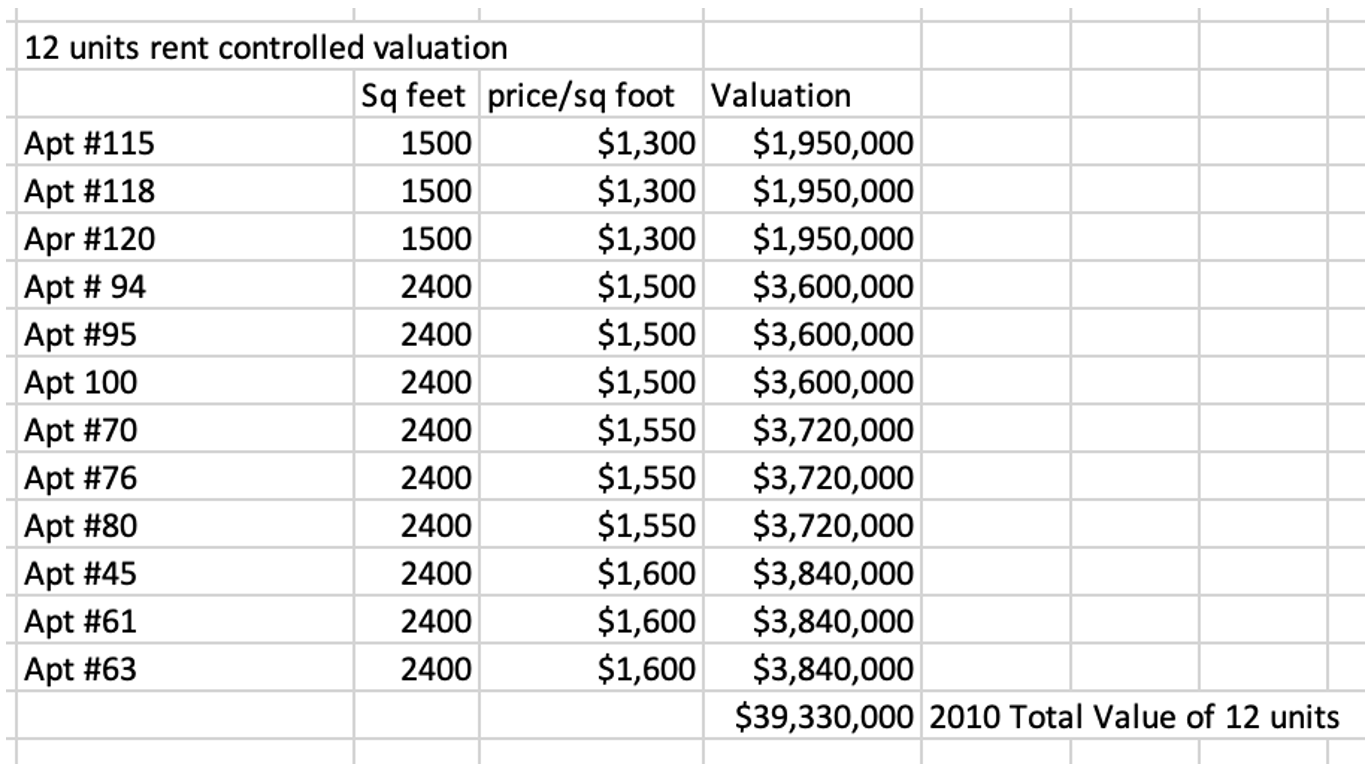

The total value for 122 residential unis is approximately $188M, but this number includes twelve apartments that are rent controlled and which cannot be sold. If Trump were to provide information about which apartments are rent controlled then the total value for those 12 units could be used to adjust the current estimate at $188M. In Table 3 we Identify, by random selection, 12 units as rent stabilized. We calculate their total value using the same model used for the other units above.

Table 3. Based on the floor of the apartment, the square footage is identified, the price per square foot is incorporated into column three, and the total valuation is calculated at $39M for the 12 units. See the bottom cell in the 4th column.

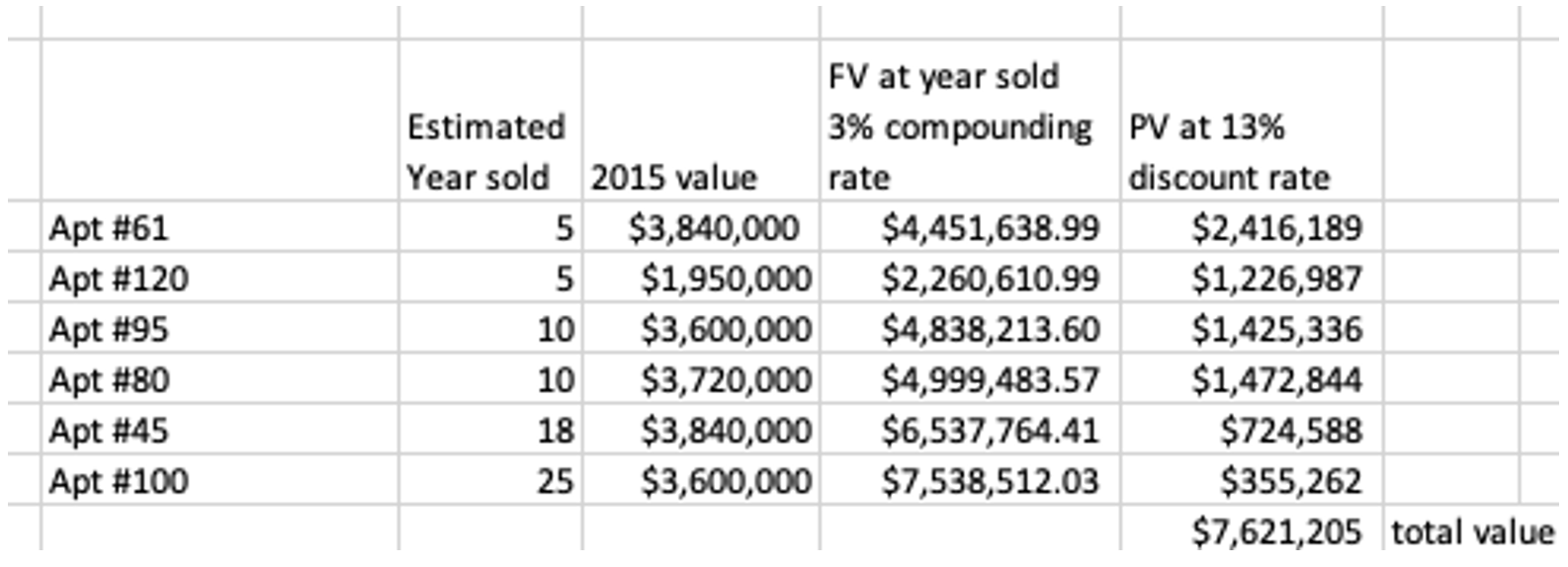

Now, we need to derive a financial model which incorporates the fact that some portion of the 12 units will be vacated, at some point, and sold at market values. We can assume that the valuation of $750K for the 12 units was calculated using a perpetuity formula model for the annual rent roll in 2010 and that $750K is likely too low of a valuation for those apartments.[1] A reasonable estimate is that at least 50% of the units will be vacated over the course of twenty-five years. We randomly select 50% of the units that will sell into the future, adding a 3%, annual appreciation. Then we calculate a discount rate of 13% based on prime rate for 2010 (3.25%) plus 11.75% for the adjusted risk of selling later than expected or not selling at all. See Table 4, here below, for the calculations.

Table 4. Here, we identify six of the twelve units at Trump Park Avenue which were rent controlled in 2010. The 2010 valuation for these units, based on comparable sales, is in the third column and then the 4th and 5th column contain future valuations based on a 3% annual appreciation up to the point of sale and then present value calculations based on these same units selling at variable years out from 2010, namely 5 years out, 10, 18, and 25.

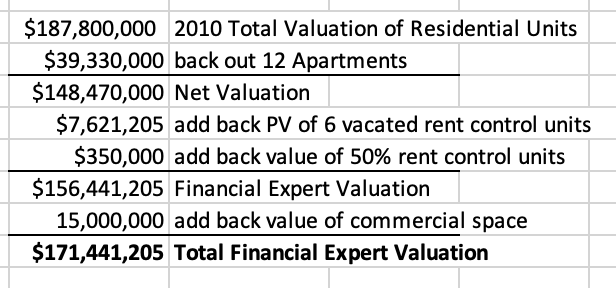

Our total valuation in this simulated model is approximately $7.6M for 50% of the units that sell plus the $350K for the remaining rent control units, using Oxford’s methodology which gets us to a total of $7.85M for the twelve rent-controlled units. Once you back out the $39M for the original valuation for those 12 units and then add back $7.85M you can calculate a total value for the entire residential space at the Trump Park Avenue building which yields approximately $156M. If you go with $15M for the commercial space, which is not contested in the Complaint, that brings the valuation for the entire building to $171M. See Table 5. for the final calculations.

Table 5. Here we start with a working valuation for the residential space at Trump Park Avenue of $187M and then back out the total value of the 12 units that are rent controlled. That leaves us with a net value of $148M. We add back the $7.6M for six apartments we estimate will be vacated and sold over the next 25 years and then add back $350K for the other six units which will remain rent stabilized. That leaves us with a valuation of $156M. We keep the $15M value for the commercial space since it is not contested in the Complaint and we arrive at a valuation, for the building, of approximately $171M.

While this is not necessarily the correct valuation since actual, verified data, is required to do this type of work, the steps taken demonstrate the various schedule items, the assumptions, and the modeling techniques that a financial expert in real estate appraisals would bring to this important civil action. The financial model just described is the type of work njexpertwitness.com delivers to attorneys when clients face accusations of fraud, negligent misrepresentation, or even breaches of contract where property value or rental income value is in dispute. Attorneys use our reports to forge settlements or to compose motions for summary judgement which can result in fast and final adjudications that dispose of cases in a single motion cycle. While that is the exception and not the rule, our work is vital and extremely useful so that attorneys can forge the best legal strategies to move a case forward or to prepare for a trial.

END NOTES

[1] On average, Oxford used an estimated 23% appreciation rate due to rent control turnover into market rent revenue, post 2010. X/23% = 750K, which yields X = $172,500 as the annual rental income for the 12 units in 2010. This means approximately $14,375 annual income per apartment or $1200 per month. That monthly rent figure is low for a New York City apartment on Park Avenue in 2010 that was rent stabilized. The 23% appreciation rate on rental income is arbitrary. A valuation on rental income alone also fails to recognize that at some point the rent stabilized apartments will be vacated and can be sold as condominiums at market rates.

Warning: Undefined variable $is_full_content in /home/u845248716/domains/njexpertwitness.com/public_html/wp-content/themes/woodmart-child/single-post.php on line 106

Warning: Undefined variable $parts_btn in /home/u845248716/domains/njexpertwitness.com/public_html/wp-content/themes/woodmart-child/single-post.php on line 106